MODEM LINKEM WLTFGT-145ACN dualband wifi wireless 2.4 ghz 5 ghz da interno USATO EUR 39,90 - PicClick IT

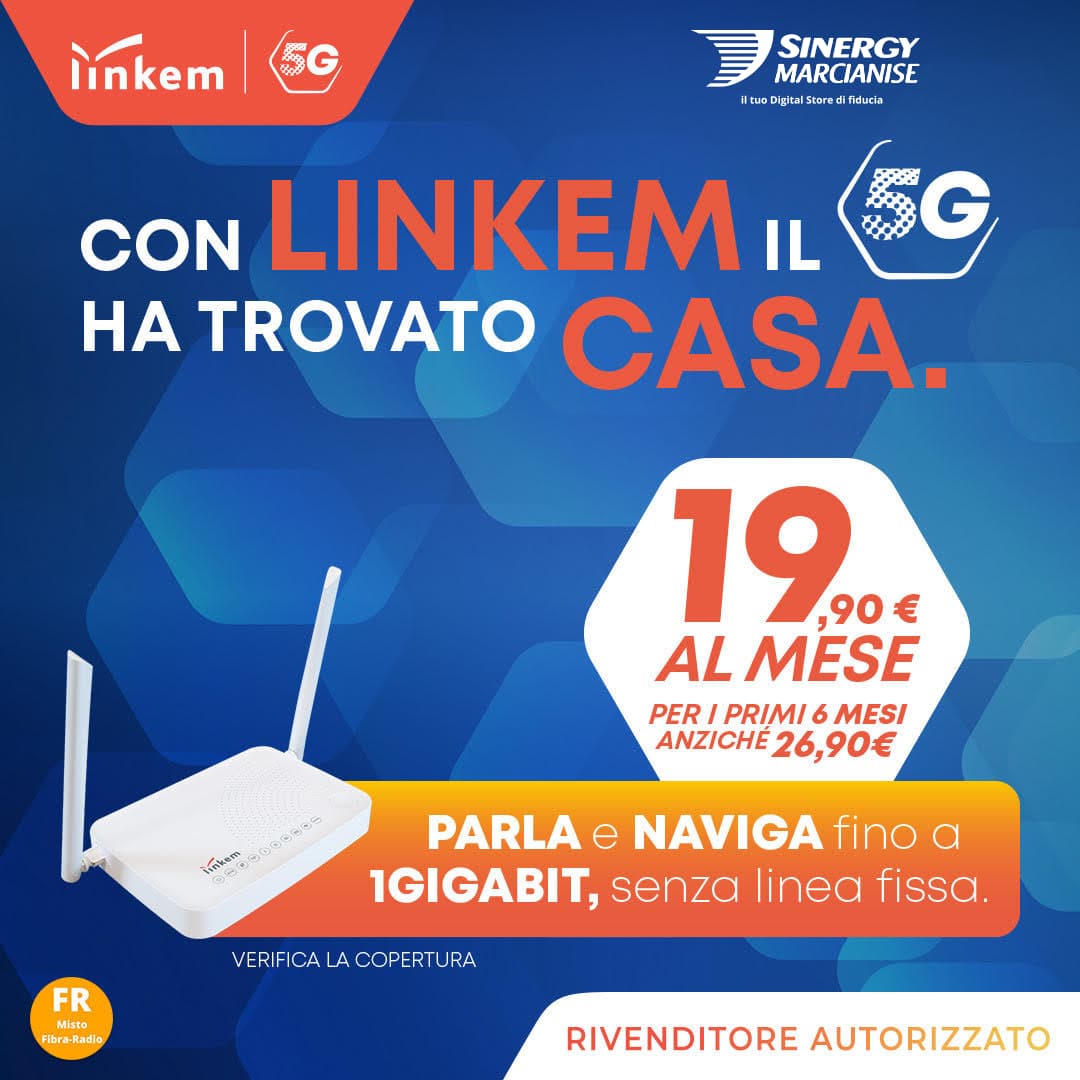

Linkem Senza Limiti Maxi Promo: nuova offerta a 19,90 euro al mese per i primi 6 mesi - MondoMobileWeb.it | News | Telefonia | Offerte

Linkem Salento - Nuovo modem esterno Linkem CAT12 tecnologicanente molto avanzato, predisposto per il 5G, prenotazione entro il 26 Aprile chiamando lo 3687112300, grazie. | Facebook

Linkem Senza Limiti Plus: linea FWA 5G fino a 100 Mbps anche in versione Indoor - MondoMobileWeb.it | News | Telefonia | Offerte

Unlock ZLT X21 CPE 5G Indoor CPE Sub 6GHz NSA+SA modem 5g wifi sim card Gigabit router Mobile wifi hotspot wireless amplifier - AliExpress

NEW Original Unlock ZLT X21 5G CPE Indoor router Sub 6GHz NSA+SA mesh wifi wireless modem 5g router with sim card Gigabit router

![Recensione: due mesi con Linkem … ecco com'è andata [video] – Francesco Renzo Recensione: due mesi con Linkem … ecco com'è andata [video] – Francesco Renzo](https://i.ytimg.com/vi/vrtqF2VUVnk/maxresdefault.jpg)